Think Takaful

“Selamat datang ke Think Takaful, tempat terbaik untuk perlindungan tanpa riba. Berfikirlah Takaful, selamatlah masa depan!”

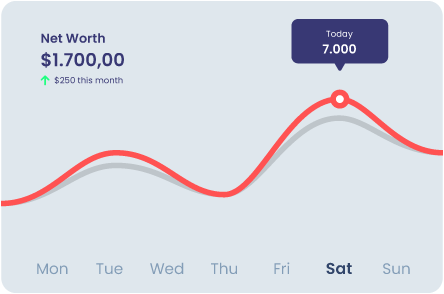

Retirement Target

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

$25.000

$125.000

Think Takaful

“Selamat datang ke Think Takaful, tempat terbaik untuk perlindungan tanpa riba. Berfikirlah Takaful, selamatlah masa depan!”

Retirement Target

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

$25.000

$125.000

- - Puteri Ibrizah binti Zolkernain

Maximize Your Wealth, Minimize Your Worries!

Saya Puteri. Saya menyediakan solusi kewangan dalam bidang takaful.

- Budgeting

- Saving & Investing

- Retirement Planning

- Debt Management

- Risk Management

- Tax Planning

- Estate Planning

- Financial Goal Setting

- Financial Education

- Monitoring & Adjusting

Overall, the function of us is to effectively manage and optimize your financial resources to achieve financial well-being, security, and long-term financial goals.

Personal Performance

We giving you the tools, knowledge, and resources to take control of your finances and achieve your financial goals.

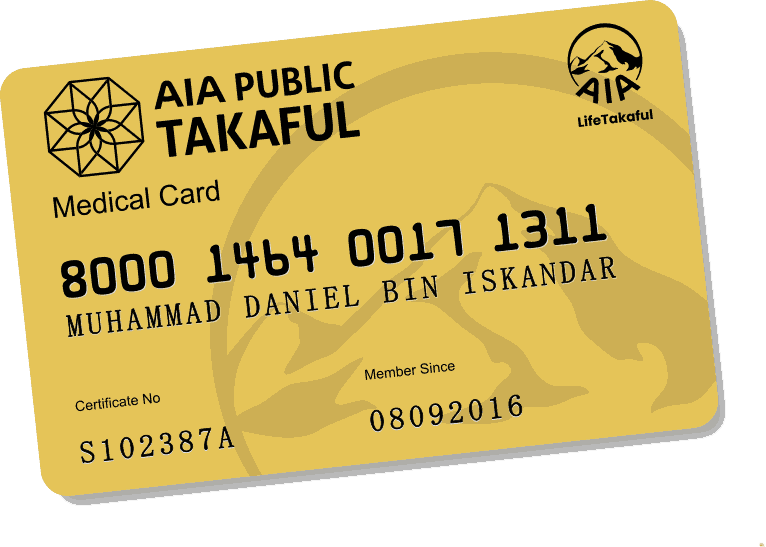

Medikal Kad

Berapa tahun kita perlu sediakan 1 juta untuk persediaan rawatan perubatan kita sehingga akhir hayat kita?

Serendah RM130 untuk mendapatkan perlindungan terbaik dari AIA.

5 Sebab Kenapa Anda Perlu Ada kad medikal peribadi Dengan Segera...

We giving you the tools, knowledge, and resources to take control of your finances and achieve your financial goals.

Get to Know Our Partners

Kenapa Anda Perlu Sediakan Hibah Untuk Keluarga Anda?

We giving you the tools, knowledge, and resources to take control of your finances and achieve your financial goals.

MELINDUNGI PENDAPATAN

MELINDUNGI PENDAPATAN

MELINDUNGI KELUARGA

MELINDUNGI KELUARGA

MENYELESAIKAN HUTANG & PINJAMAN

MENYELESAIKAN HUTANG & PINJAMAN

MENGEKALKAN GAYA HIDUP

MENGEKALKAN GAYA HIDUP

Kenapa Simpanan Akan Terhakis?

Segala simpanan anda pasti akan terhakis sedikit demi sedikit kerana ingin menampung perbelanjaan harian keluarga. Soalnya, selama mana ianya mampu bertahan?Sebab itu anda perlukan Hibah. Hibah boleh membantu mengekalkan gaya hidup anda dan keluarga sekiranya berlaku perkara yg tidak diingini ke atas diri anda.

MELINDUNGI ASET & PELABURAN

Mengumpul aset seperti rumah, tanah, simpanan dan pelaburan bukanlah suatu perkara yang mudah. Sudah pasti anda tidak mahu segalanya hilang dek kerana tiada perancangan yang rapi untuk melindungi aset-aset anda.Hibah takaful adalah instrumen paling tepat untuk melindungi aset-aset anda.

ELAKKAN DARI MEMINTA-MINTA

“Tangan yang memberi itu lebih baik daripada tangan yang meminta-minta” pernahkah anda dengar kenyataan ini?Cuba anda renungkan sebentar, bolehkah anda menamakan 5 orang yang diyakini boleh menghulurkan bantuan yang berterusan kepada keluarga anda sekiranya anda terlebih dahulu pergi meninggalkan keluarga tersayang?Jika tiada, maka Hibah takaful adalah jawapannya!

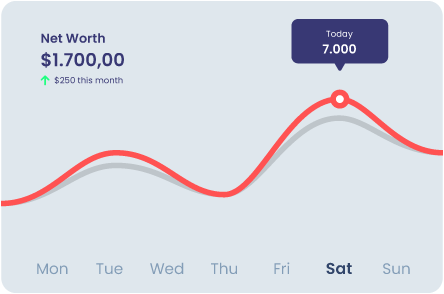

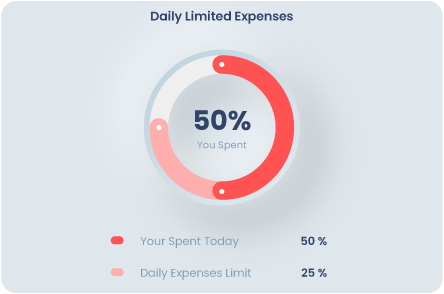

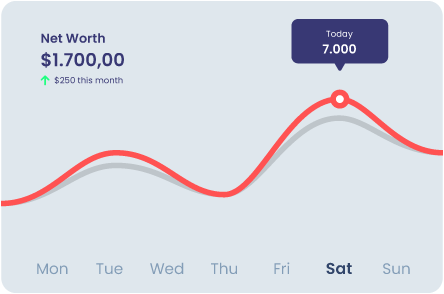

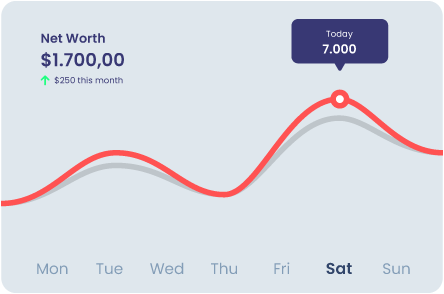

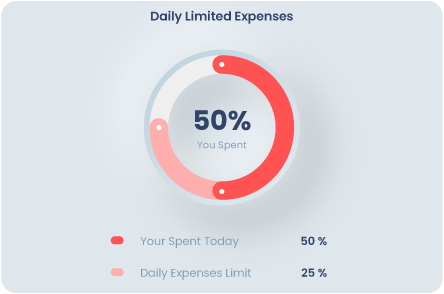

Manage Your Cash Flow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem, id congue nisl. Curabitur et elit viverra, consectetur dui in.

Spend Wisely and Save More

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem, id congue nisl. Curabitur et elit viverra, consectetur dui in.

Plan and Simulate Your Happy Retirement

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem.

Plan Simpanan

Satu-satunya platform pelaburan yang bebas aset beku jika meninggal. Pelan simpanan dengan tempoh bayaran pendek yang menyediakan perlindungan Takaful dan keuntungan pelaburan berpotensi. Sesuai untuk

- Simpanan persaraan

- Simpanan pindidikan

- Simpanan jangka panjang 6-20 tahun

- Simpanan melangsaikan hutang

- Simpanan haji

A Combination that Maximizes the Use of Your Funds.

We believe that everyone can achieve financial wellness through education and smart financial choices.

Manage Your Cash Flow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem, id congue nisl. Curabitur et elit viverra, consectetur dui in.

Spend Wisely and Save More

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem, id congue nisl. Curabitur et elit viverra, consectetur dui in.

Plan and Simulate Your Happy Retirement

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed ut laoreet sem.

Take Control of Your Money, Take Control of Your Life.

Kelebihan MLTT VS MRTT

We giving you the tools, knowledge, and resources to take control of your finances and achieve your financial goals.

SETTLEMENT

Jika pelanggan buat early settlement, MLTT tidak terbatal dan boleh digunakan untuk rumah lain. Boleh gunakan satu polisi MLTT untuk lebih daripada satu rumah. Contohnya, selepas 20 tahun pembiayaan, hutang rumah tinggal RM100,000 dan coverage MLTT masih kekal RM250,000. Jadi dia boleh beli rumah lain dan gunakan MLTT yang sama.

Akses Cepat ke Perkhidmatan Perubatan

Dengan kad medikal peribadi, anda dapat mengakses perkhidmatan perubatan dengan lebih cepat. Ini termasuk janji temu dengan pakar, ujian kesihatan, dan rawatan mendesak tanpa perlu menunggu lama.

◦ Karier

3 Program yang ditawarkan

◦ Elite Lite

RM500-RM3500

Tidak termasuk komisen

◦ Elite Pro

◦ Elite Pro II

Empowering Your Wallet, One Price at a Time.

Free

$0.00

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Ut euismod justo eu

- Nam elementum purus

- Ornare neque vehicula

Donec hendrerit consequat nunc, ultricies finibus magna convallis eu.

Pro

$79.00

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Nunc tempor accumsan

- At tincidunt sem dictum

- Integer eget suscipit

Leo tellus laoreet turpis, at ultricies lacus massa blandit est.

Premium

$99.00

Consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Proin condimentum

- Efficitur velit mattis

- Donec ornare nibh

Etiam a tincidunt diam, at gravida massa. Proin sagittis enim at ipsum.

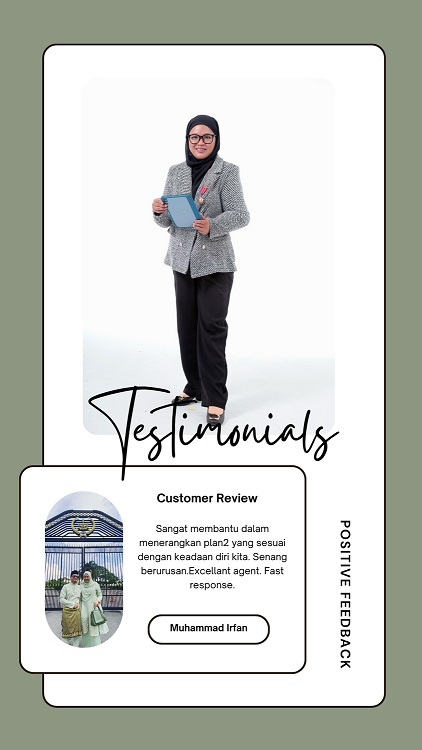

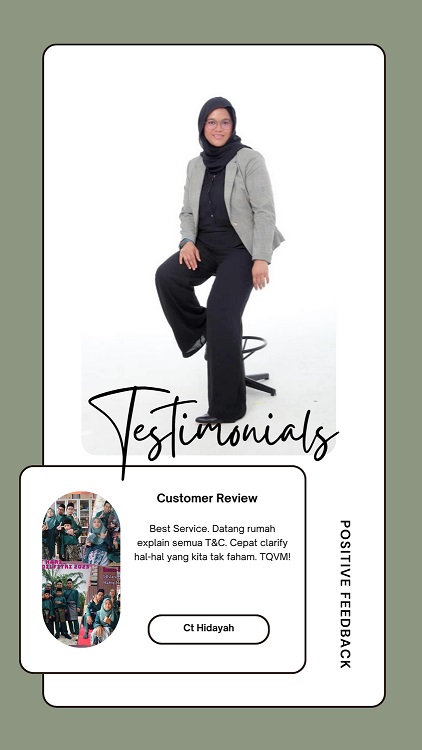

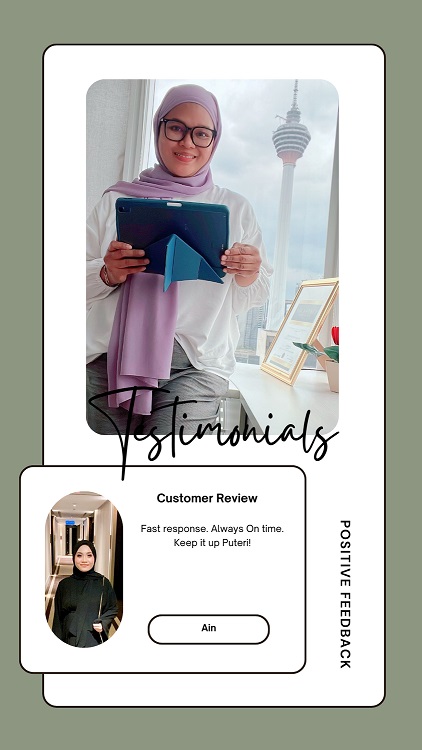

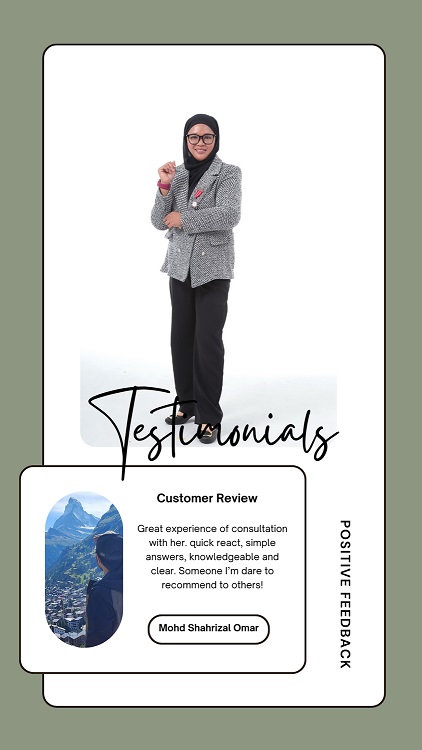

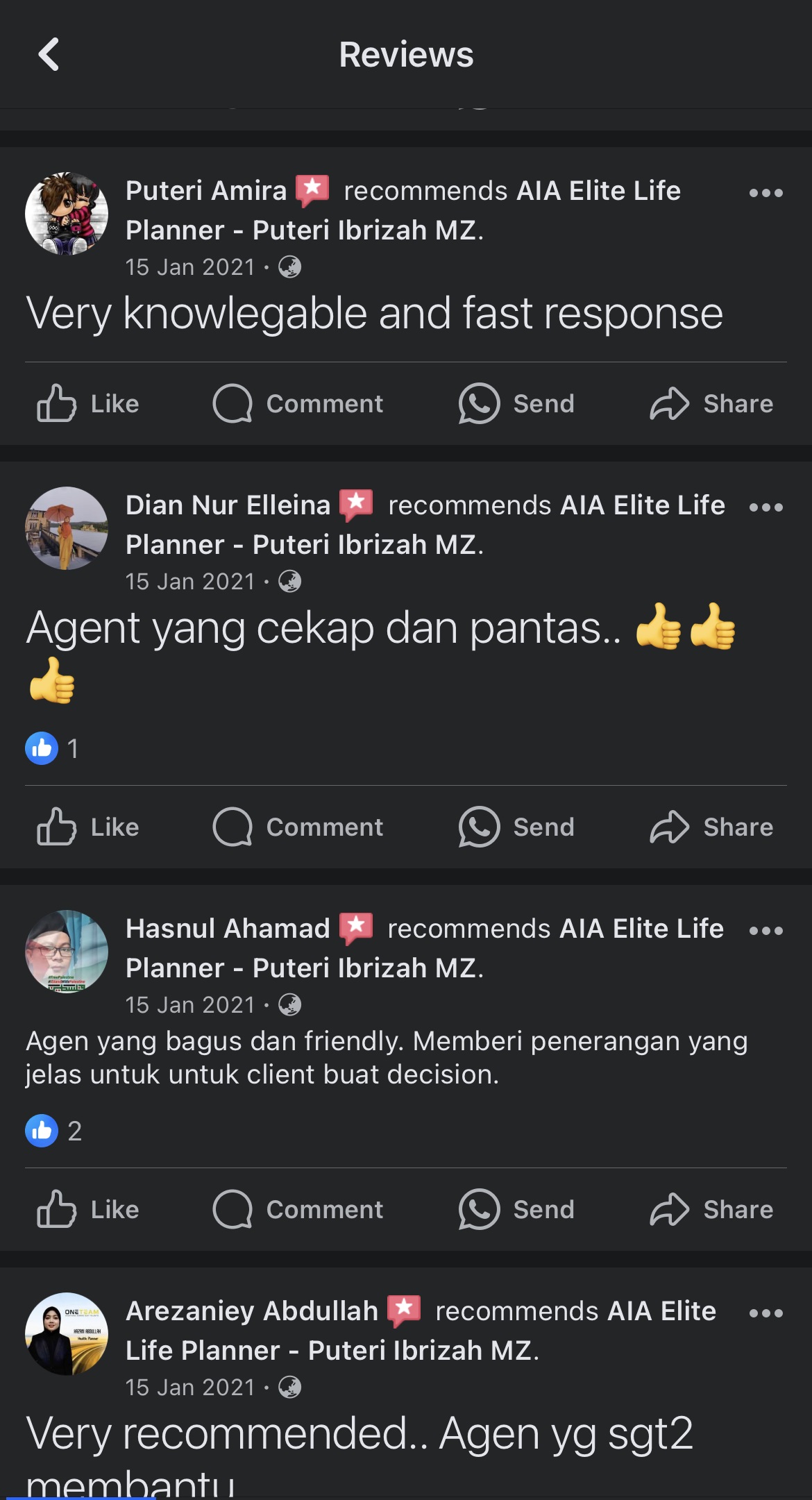

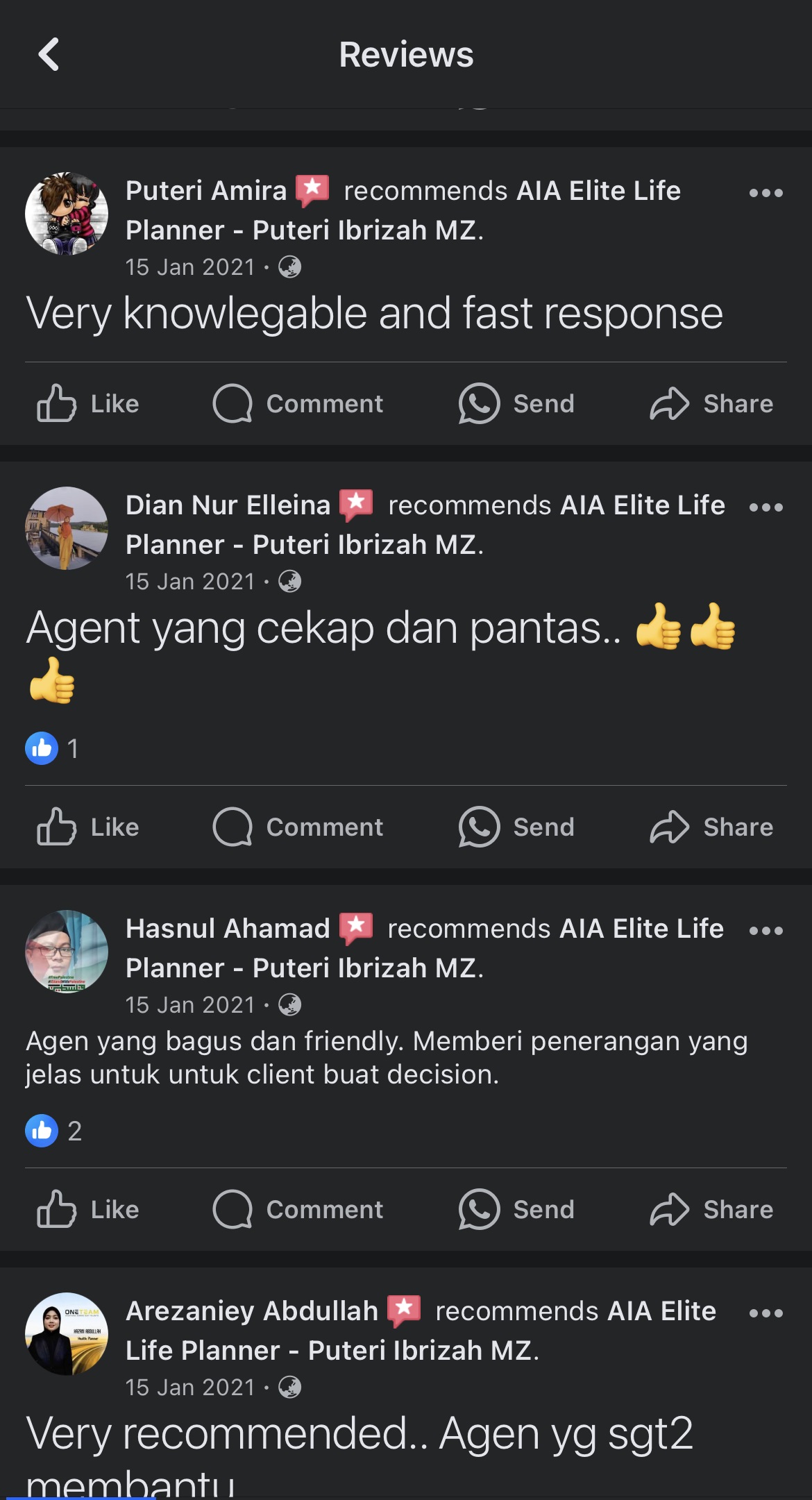

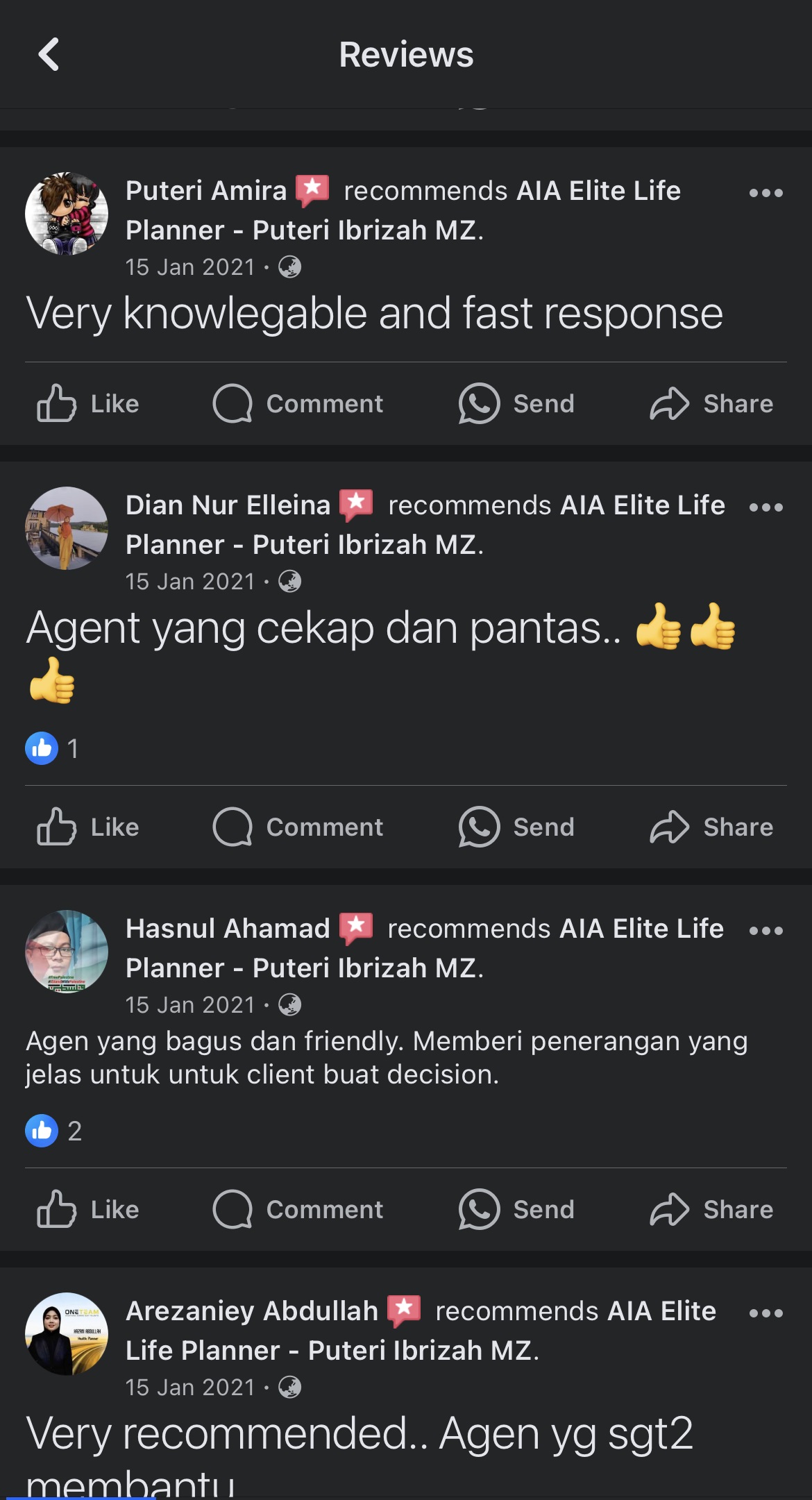

Accomplished Success

Client's Reviews

Empowering Your Wallet, One Price at a Time.

Have Any Questions? Don’t Hesitate to Reach Us.

Here are some frequently asked questions that are frequently asked to us as professional Personal Finance Services.

Personal finance refers to the management of an individual’s financial resources, including income, expenses, savings, investments, and debt. It is important because it helps individuals make informed decisions about their finances, plan for their future, and achieve their financial goals.

To create a budget that works for you, start by tracking your income and expenses for a few months to get a sense of your spending habits. Then, identify areas where you can cut back on expenses and allocate your income towards your financial goals, such as saving for a down payment on a house or paying off debt. Be sure to review and adjust your budget regularly to ensure it stays on track.

One strategy for paying off debt is the snowball method, where you start by paying off your smallest debt first and then work your way up to larger debts. Another strategy is the avalanche method, where you focus on paying off debts with the highest interest rates first. Whichever strategy you choose, be sure to make consistent payments and avoid accumulating new debt.

The amount you should be saving for retirement depends on several factors, including your current age, retirement age, expected retirement expenses, and expected retirement income. A general rule of thumb is to save at least 10-15% of your income for retirement, but consulting with a financial advisor can help you determine a more personalized savings goal.

Some good investment options for beginners include index funds, which offer low fees and diversification, and robo-advisors, which use algorithms to create a personalized investment portfolio based on your goals and risk tolerance. It’s important to do your research and understand the risks associated with any investment before committing your money.

Question we Had

Latest News & Articles

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Quotation

Anda ingin tahu berapa jumlah Caruman (Premium) bulanan/tahunan untuk pelan pilihan anda dan keluarga anda? Dapatkan Quotation secara PERCUMA.

- Setiap individu memerlukan perlindungan yang berbeza mengikut kepada Profil Gaya Hidup masing-masing. Sila lengkapkan Profile Gaya Hidup anda selengkapnya untuk mendapatkan nilai caruman Bulanan yang tepat.

- Dengan melengkapkan Profil Gaya Hidup ini, anda masih belum membuat pembelian polisi takaful lagi. Profil Gaya Hidup ini hanyalah digunakan untuk menyatakan PROPOSAL sahaja.

Contact

- [email protected]

- AIA Capsquare Tower , Jalan Munshi Abdullah, City Centre, 50100 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur

- 60326186785

- 60163460773

Copyright 2024 © All Right Reserved | Think Takaful | Design by Cybercypher.my

Copyright 2024 © All Right Reserved | Think Takaful | Design by Cybercypher.my